Condo Insurance in and around San Antonio

Townhome owners of San Antonio, State Farm has you covered.

Cover your home, wisely

There’s No Place Like Home

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected loss or mishap. And you also want to be sure you have liability coverage in case someone becomes injured on your property.

Townhome owners of San Antonio, State Farm has you covered.

Cover your home, wisely

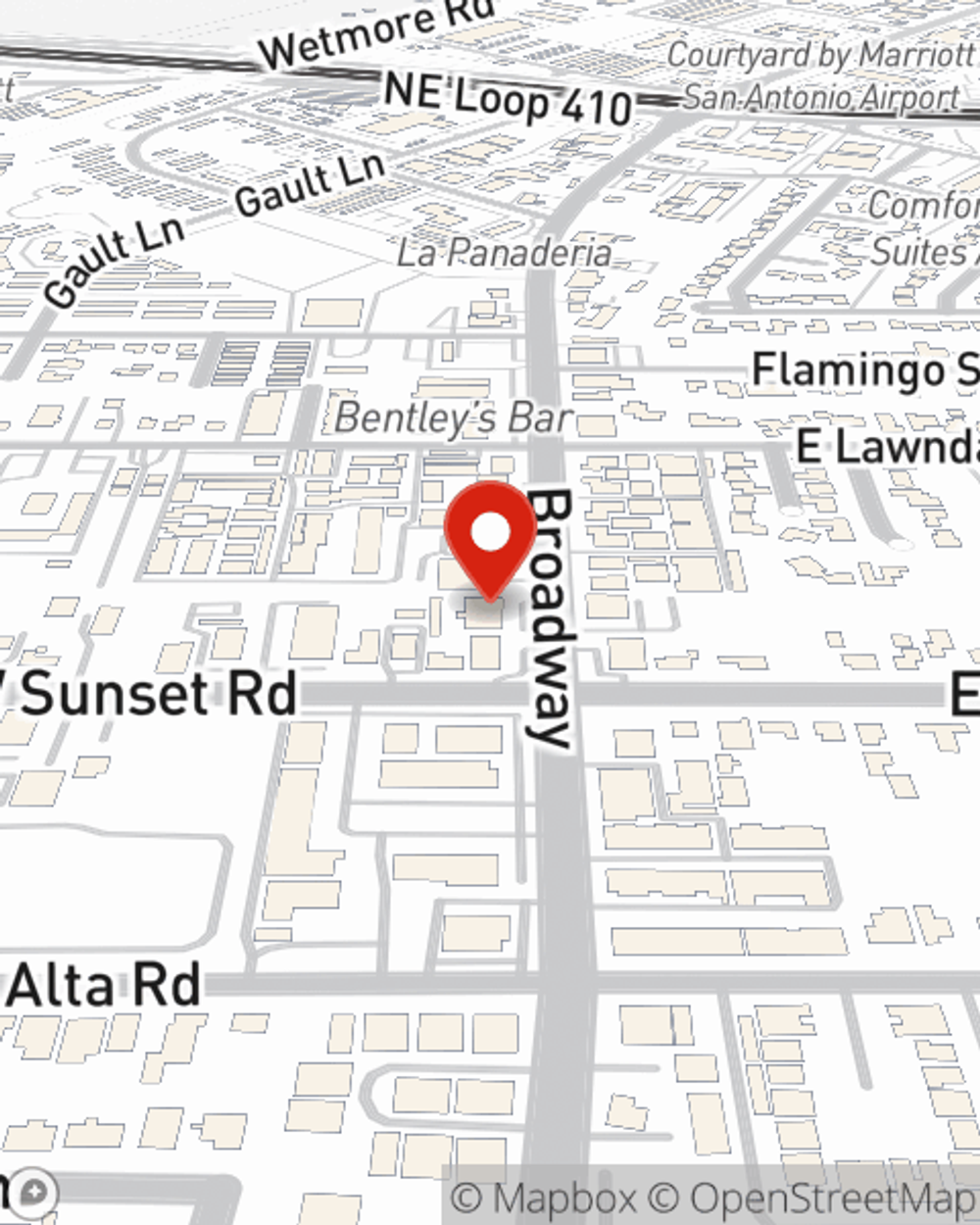

Agent Blake Kohutek, At Your Service

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Blake Kohutek is ready to help you handle the unexpected with dependable coverage for all your condo insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Blake Kohutek can help you submit your claim. Keep your condo sweet condo with State Farm!

Terrific coverage like this is why San Antonio condo unitowners choose State Farm insurance. State Farm Agent Blake Kohutek can help offer options for the level of coverage you have in mind. If troubles like identity theft, wind and hail damage or drain backups find you, Agent Blake Kohutek can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Blake at (210) 824-7436 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Blake Kohutek

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.